The Prevention of Money Laundering Act, 2002 (PMLA) is a crucial legislation in India aimed at combating the menace of money laundering. This law not only addresses the complex process of transforming illegal money into legitimate assets but also establishes a framework for penalizing offenders and confiscating illicit gains. With stringent regulations, PMLA aims to preserve the integrity of the financial system, prevent financial crimes, and promote economic stability. Vera Causa Legal, recognized as the best law firm in Noida, provides comprehensive legal services under PMLA, ensuring compliance and effective legal representation.

Understanding Money Laundering

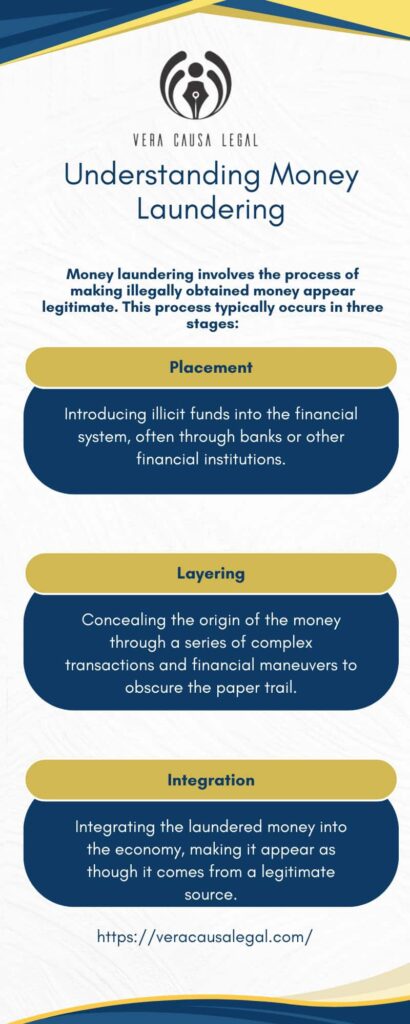

Money laundering involves the process of making illegally obtained money appear legitimate. This process typically occurs in three stages:

- Placement: Introducing illicit funds into the financial system, often through banks or other financial institutions.

- Layering: Concealing the origin of the money through a series of complex transactions and financial maneuvers to obscure the paper trail.

- Integration: Integrating the laundered money into the economy, making it appear as though it comes from a legitimate source.

Common methods of money laundering include smurfing (breaking down large amounts of money into smaller, less suspicious amounts), using offshore accounts to hide funds in foreign jurisdictions with lax regulations, and creating shell companies to disguise the true ownership and source of funds. These techniques complicate the tracking of illegal funds and make it challenging for authorities to detect and prevent money laundering activities.

Expanded Objectives of the Prevention of Money Laundering Act, 2002 (PMLA)

Prevent and Control Money Laundering

The foremost objective of the PMLA is to prevent and control the act of money laundering, which involves the conversion of black money into white money. By establishing a comprehensive legal framework, the Act aims to disrupt and dismantle the operations of individuals and entities involved in the creation and distribution of illicit wealth. It seeks to ensure that financial transactions in the economy are transparent and traceable, thereby reducing the opportunities for money laundering.

Confiscate and Seize Property Obtained from Laundered Money

The PMLA empowers authorities to confiscate and seize properties and assets acquired through the proceeds of crime. This provision acts as a deterrent for criminals by ensuring that their illicit gains are not safe from legal action. It enables the government to deprive offenders of their illegally obtained wealth, thus weakening the financial infrastructure that supports criminal activities. The process includes the attachment of property and, ultimately, its forfeiture to the state.

Obligate Financial Institutions and Intermediaries to Maintain Records and Report Suspicious Transactions

Financial institutions and intermediaries play a crucial role in the fight against money laundering. The PMLA mandates these entities to implement robust Know Your Customer (KYC) procedures, maintain detailed records of all transactions, and report any suspicious activities to the Financial Intelligence Unit-India (FIU-Ind). These requirements ensure that there is a transparent and accountable trail of financial transactions, making it easier to detect and investigate money laundering activities.

Provide Legal and Administrative Measures to Combat Money Laundering Effectively

The PMLA provides a strong legal and administrative framework to combat money laundering. It establishes the necessary authorities and procedures for the investigation and prosecution of money laundering cases. The Act outlines the responsibilities of various regulatory bodies and law enforcement agencies, fostering cooperation and coordination among them. This comprehensive approach ensures that money laundering is tackled from multiple angles, enhancing the effectiveness of anti-money laundering efforts.

Key Provisions of the Prevention of Money Laundering Act, 2002 (PMLA)

Offenses and Penalties

The Prevention of Money Laundering Act, 2002 (PMLA) categorizes money laundering as a serious offense with stringent penalties. Individuals who engage in the act of concealing, possessing, acquiring, or using proceeds of crime face severe legal repercussions, including imprisonment and hefty fines. These provisions aim to deter illegal activities and ensure that offenders are held accountable for their actions.

Reporting Entities

Under the PMLA, certain entities are designated as reporting entities, which include banks, financial institutions, and intermediaries. These entities have specific obligations to ensure transparency and compliance with the law:

- Maintaining Records: Reporting entities must maintain detailed records of all financial transactions. This includes documenting the nature, value, and parties involved in the transactions.

- Know Your Customer (KYC) Norms: Entities are required to verify the identity of their clients through stringent KYC procedures. This involves collecting and validating identification documents, ensuring that the clients are who they claim to be.

- Reporting Suspicious Transactions: Reporting entities must report any suspicious transactions to the Financial Intelligence Unit-India (FIU-Ind). Suspicious transactions are those that deviate from the client’s usual financial behavior or seem to lack a legitimate purpose. This reporting helps in the early detection and investigation of potential money laundering activities.

These provisions ensure that the financial system is safeguarded against misuse and that there is a robust mechanism in place for monitoring and reporting suspicious activities.

The key provisions of the PMLA, including the definition of offenses and penalties, as well as the obligations of reporting entities, form the backbone of India’s anti-money laundering framework. By enforcing these provisions, the PMLA helps maintain the integrity of the financial system and combat financial crimes effectively. Vera Causa Legal, renowned as the best law firm in Noida, offers expert legal services to assist clients in navigating the complexities of the PMLA, ensuring compliance and providing robust legal representation.

Compliance Requirements

Client Due Diligence

Reporting entities must conduct thorough due diligence on clients to prevent money laundering. This includes verifying the identity of clients, understanding the nature of their business, and monitoring transactions for suspicious activity.

Record-Keeping and Reporting

Entities are mandated to maintain records of all transactions for a specified period and report any suspicious transactions to the FIU-Ind. This helps in tracking illegal activities and providing evidence for legal proceedings.

Training and Awareness

Organizations must train their employees on anti-money laundering (AML) and countering the financing of terrorism (CFT) measures. This ensures that staff can identify and report suspicious activities effectively.

Enforcement and Legal Representation

Vera Causa Legal excels in providing specialized legal services for PMLA compliance and litigation. Our experienced lawyers offer comprehensive assistance to ensure clients adhere to Anti-Money Laundering (AML) regulations, safeguarding their interests and maintaining compliance with the law. Our services include:

- Registration with FIU-Ind: Assisting clients in registering with the Financial Intelligence Unit-India.

- AML Policies: Developing robust AML policies tailored to client needs.

- Legal Representation: Representing clients in legal proceedings involving money laundering allegations.

The Prevention of Money Laundering Act, 2002, is essential for maintaining the integrity of India’s financial system. Through rigorous regulations and enforcement, the PMLA aims to combat financial crimes effectively. Vera Causa Legal, as the best law firm in Noida, provides expert legal support, ensuring compliance and robust representation under the PMLA. Our dedication to excellence and client-centric approach makes us a reliable partner in the fight against money laundering.

Role of Vera Causa Legal

Comprehensive Legal Support under PMLA

As the best law firm in Noida, Vera Causa Legal offers extensive expertise in providing legal services related to the Prevention of Money Laundering Act (PMLA). Our specialized services include:

- Advising on Compliance with AML Regulations: We guide clients in adhering to Anti-Money Laundering (AML) regulations, ensuring they meet all legal requirements.

- Legal Representation: Our experienced lawyers represent clients in legal proceedings involving allegations of money laundering.

- Internal Controls and Compliance Mechanisms: We assist in developing robust internal controls and compliance mechanisms to prevent money laundering within organizations.

- Training and Awareness Programs: We provide comprehensive training programs to organizations, raising awareness about AML practices and ensuring that employees are well-informed about their responsibilities under the PMLA.

Our commitment to excellence and client-centric approach ensures that Vera Causa Legal remains a trusted partner in navigating the complexities of AML regulations and safeguarding the interests of our clients.

The Prevention of Money Laundering Act, 2002, plays a crucial role in maintaining the integrity of India’s financial system. Through stringent regulations and comprehensive enforcement mechanisms, the PMLA aims to combat financial crimes effectively. Vera Causa Legal, recognized as the best law firm in Noida, offers unparalleled legal support, ensuring compliance and providing robust representation in matters related to the PMLA. Our expertise and dedication to client service make us a reliable partner in the fight against money laundering.

Conclusion

The Prevention of Money Laundering Act, 2002, is a vital tool in India’s fight against financial crime. By establishing stringent measures to detect and prevent money laundering, the PMLA helps maintain the integrity of the financial system and promotes economic stability. Vera Causa Legal, with its expertise in PMLA compliance and litigation, stands as a trusted partner for individuals and organizations seeking to navigate the complexities of AML regulations. Our commitment to legal excellence and client-centric approach ensures that we deliver effective solutions tailored to the unique needs of our clients.