In realm of real estate the dream of owning a home can turn in a nightmare if the developer stuck in financial troubles. For home buyers in India such situations can lead to prolonged delays or even abandonment of their projects. When faced with these challenges , understanding the legal recourse available becomes crucial. One of the significant avenues for recourse is through insolvency proceedings initiated by home buyers in the national company law tribunal(NCLT).

Understanding the landscape of real estate insolvency

Real estate projects involves substantial investments from buyers who rely on developers to deliver their promised homes on time. However , financial mismanagement or economic downturns can jeopardize these projects, leaving buyers in a precarious position. In such cases the insolvency and bankruptcy code (IBC) of India provides a framework for creditors, including home buyers to seek remedies.

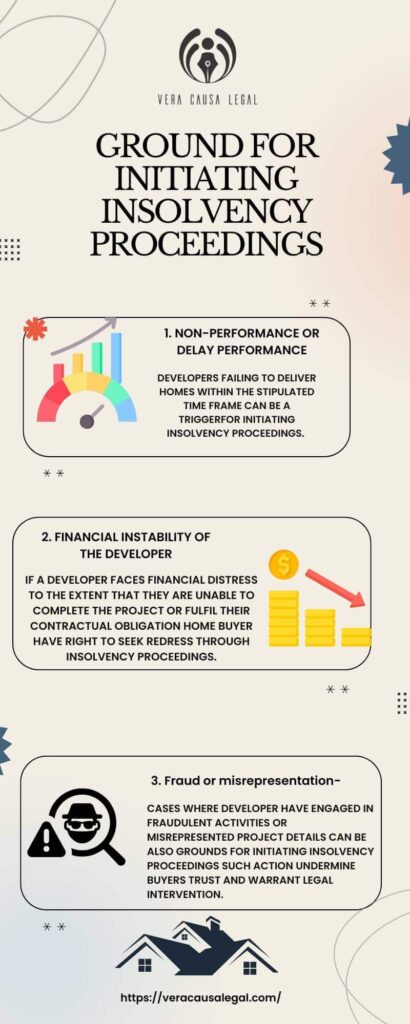

Ground for initiating insolvency proceedings

Non-performance or delay performance

Developers failing to deliver homes within the stipulated time frame can be a trigger for initiating Insolvency proceedings. Delay beyond the agreed upon completion date can severally impact buyers financial planning and personal circumstances.

Financial instability of the developer

If a developer faces financial distress to the extent that they are unable to complete the project or fulfil their contractual Obligation home buyer have right to seek redress through insolvency proceedings.

Fraud or misrepresentation

Cases where developer have engaged in fraudulent activities or misrepresented project details can be also grounds for initiating insolvency proceedings such action undermine buyers trust and warrant legal intervention.

Legal process

Filing a petition

Home buyers as financial creditors under the IBC, can file a petition for initiating insolvency proceedings against the real estate developer. This petition is typically filed with the NCLT, the designated forum for resolving corporate insolvency matters in India.

Admission and appointment of interim resolution professional

Upon admission of the petition by the NCLT, an interim resolution professional (IPR) is appointed to manage the affairs of the developer during the insolvency resolution process. The IPR assesses the financial position of the developer and seeks resolution proposals from stakeholders.

Insolvency resolution process

During the IPR, the IPR oversees operation and explores options for reviving the project or liquidating assets to repay creditors. Home buyers actively participate in this process to safeguard their interests and ensure the completion of their homes.

Resolution plan approval

The culmination of the IPR involves the approval of a resolution plan by the creditors, including home buyers. This plan outlines how the developer intends to resolve its financial distress and complete the project, thereby ensuring that buyers receive their homes as promised.

Challenges and considerations

1. Complexity of legal proceedings-

Insolvency proceedings can we both legally complex and time consuming demanding careful navigation To safeguard wire interest buyers must engage in those proceedings with thorough Legal guidance to ensure they protect their investments and comply with regulatory requirements the process of an involves detailed scrutiny of the insolvent entity assets, Liability and creditor claims requiring expertise to interpret and act upon legal professionals like vera causa legal play crucial role in guiding buyers through negotiation understanding insolvency laws and mitigating risks associated with purchasing distressed assets without this expertise buyer may face unexpected liabilities or complications. Therefore securing competent legal counsel is essential for navigating the intricacies Of insolvency proceedings effectively and insuring a favorable outcome in such high stakes transactions.

2. Impact on project completion

While insolvency proceedings aim to revive project there may be instances where liquidation becomes unavoidable. Home buyers should prepare for potential delays and uncertainties in such scenarios.

3. Coordination amongst creditors

Ensuring alignment among various creditors including financial institutions and other buyers is crucial for achieving consensus on the resolution plan and moving the project towards completion.

Case studies

AMRAPALI GROUP CASE

The Amrapali group insolvency case stands out as a landmark example where-buyers successfully initiated insolvency proceedings leading to the completion of several stalled projects under the supervision of the NCLT.

JAYPEE INFRATECH CASE

Similarly, the jaypee Infratech insolvency case highlighted the challenges faced by home buyers and the role of the NCLT in safeguarding their interest eventually resulting in a resolution plan that aimed to address buyers concerns.

Conclusion

Navigating complexities of real estate insolvency proceedings can be Daunting for homebuyers’ affected by delay or stalled Projects. However the IBC provides a structured legal framework that empowers buyer to take proactive measures against financial distressed developers. By understanding the right and responsibilities under the law home buyers can effectively utilize insolvency proceedings to secure their investments and ensure the timely completion of their homes.

In essence, while challenges may abound, the avenue of insolvency proceedings offers a ray of hope for home buyers seeking justice and resolution in the face of adversity in India’s dynamic real estate sector. For those navigating these complex issues, the best law firm in Noida, Vera Causa Legal, provides expert guidance and support.